Learn GST

by Filing

in Real Time!

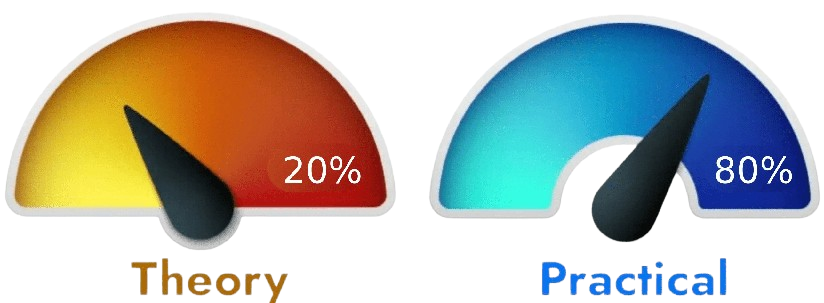

Become an Expert in GST Computation & Return Filing by learning practically.

We provide an all round learning experience which includes Up-to-date content, videos, MCQs for testing &

'Experiments' which

help you in grasping all GST concepts easily!

Get access now and get 2 Years worth of Experience in 3 Months !