Tax Specialisation

Taxation in India is majorly divided into Central and State Govt taxes with two types of taxes: 1. Direct Taxes 2. Indirect Taxes While direct taxes are levied on your earnings in India, indirect taxes are levied on expenses. The responsibility to deposit the direct tax liability lies with the earning party, whether individual, HUF or a company. Indirect taxes are collected majorly by the corporates and businesses providing services and products. Thus, the responsibility to deposit indirect taxes lies with these entities.

View DemoCourse Syllabus

- GST Basics

- GST Invoice preparation

- Debit Note & Credit Note

- E-Way Bill

- Concept of RCM, TDS & TCS

- GST Computation

- GST Return Filing (Online)

- GST Returns in Tally (Offline)

- TDS on Salary

- TDS on Other than Salary

- TDS Return on Salary (Form 24Q)

- TDS Return on Non-Salary (Form 26Q)

- TDS Rectification

- Income Tax Basics

- Salary & Allowances

- Income from House property

- Capital Gain and other sources

- Deductions & IT Computation

- Advance tax Computation of an Individual

- Basics of IT Returns

- Income Tax Return Filing (ITR-1)

- Income Tax Return Filing (ITR-2)

- Income Tax Computation of a Business Entity

- IT Computation of a Partnership Firm

- IT Computation of a Company

- Depreciation Computation as per IT Act

- Depreciation computation as per Companies Act

Get access to this course in Lab & Lab+. Compare

Lab+ Recorded

5% Off

₹12240

₹11016

Lab+ Live

5% Off

₹20400

₹20400

This course includes:

Modules

7

Chapters

27

MicroVideos

151

Case Studies

90

Assessments

276

Simulations

159

Experiments

92

Recordings

10+

Languages

15

Compare Lab & Lab+

| Lab | Lab+ |

|---|

Get Practical Experience with Simulation!

Simulation, as the name suggests, will let you experience the real world experience in a safe environment. You can try Return Filing as many times as you want without any hassles from the real portal!

Conduct unlimited experiments in FINC Lab you want.

File returns in Government (exact same) portal (Full Simulation)

How you'll learn!

Practically learn in our Lab! Get the best practical experienece in all topics with Case Studies, Gamification, Simulation etc. in your language!

Recommended Courses for you!

More Features in Lab!

Interactive UI

You will not just learn the subject material, you will Experience it! You will be asked to complete small tasks and answer a few questions which helps you in remembering the topic for a longer time.

Learn in 15+ Languages with AI

Not able to understand technical words? Translate it to the language of your choice and learn easily! 15 Languages are currently supported, and we are adding more soon...

Earn FinC Coins!

Every time you Input the correct answer, or achieve something in the given time, you will be awarded with Coins! Use these to get discounts on future courses and get discounts!

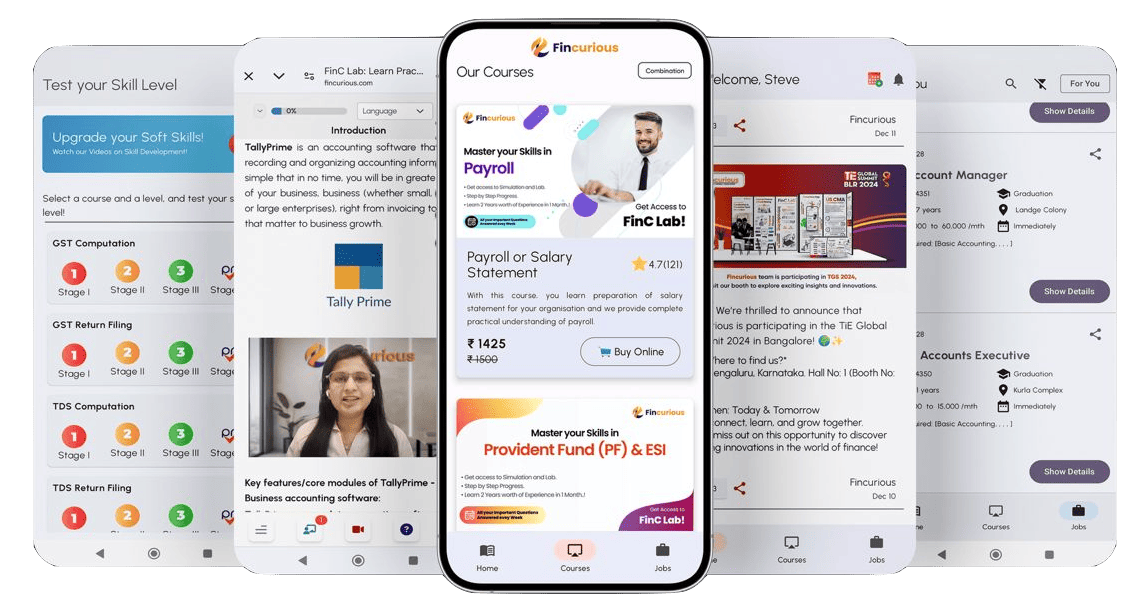

Download our App

Download our Android app and get access to the same study materials on the go! Also get notifications about when the class is starting or when your access is about to expire.

Full Access to all Features

Get the best Offers!!

Revise and Play to upgrade your skills!

Access Everything

from Everywhere!

Have More Questions?

Submit your details. Our Team will get back to you shortly.