Goods & Service Tax (GST)

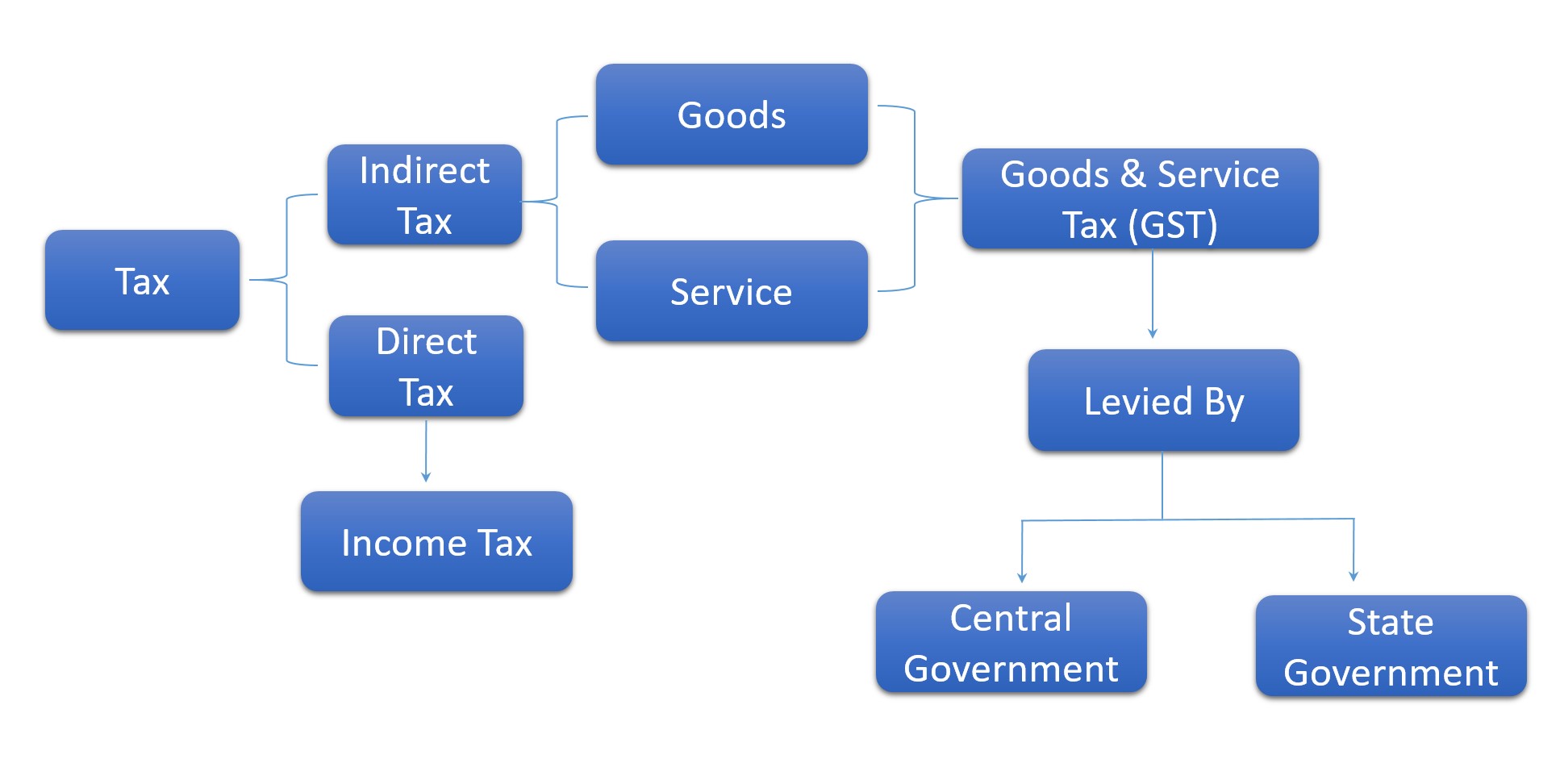

GST is a value added tax levied on supply i.e. manufacture, sale and consumption of goods and services except alcoholic liquor for human consumption, petroleum crude, diesel, petrol and natural gas.

GST is a destination based tax on all supplies applicable on all transactions involving supply of goods and services for a consideration.

Why was GST implemented in India?

In the earlier indirect tax regime, there were many indirect taxes levied by both the state government and the central government (Centre). States mainly collected taxes in the form of Value Added Tax (VAT). Every state had a different set of rules and regulations.

Inter-state (one state to another) sale of goods was taxed by the centre. CST (Central Sales Tax) was applicable in case of inter-state sale of goods. The indirect taxes such as the entertainment tax, octroi and local tax were levied together by state and centre. These led to a lot of overlapping of taxes levied by both the state and the centre. Further, there was Service tax levied by the centre across the country.

For example, when goods were manufactured and sold, excise duty was charged by the centre. Over and above the excise duty, VAT was also charged by the state. It led to a tax on tax effect, also known as the cascading effect of taxes.

The following are some of the indirect taxes in the pre-GST regime merged with GST

Genesis of GST in India:

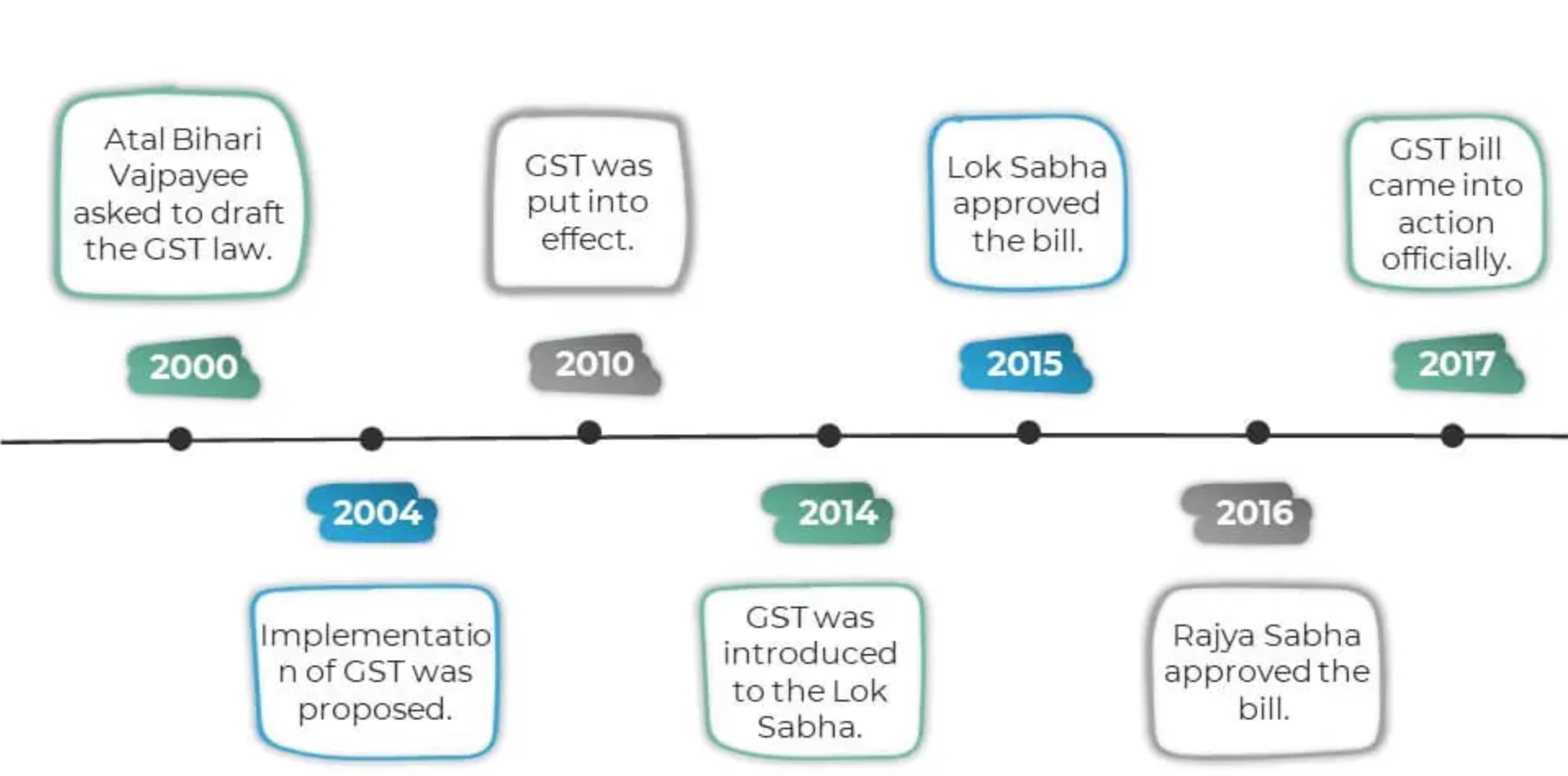

In the year 2000, the then Prime Minister of India introduced the concept of Goods and Services Tax. He also formed a committee to draft new indirect tax law.

However, it took 17 more years for its implementation. Meanwhile, the bill went through multiple introductions, amendments and rescheduling.

- 2000- Prime minister Atal Bihari Vajpayee set up a committee led by Ashim Dasgupta (former finance minister of West Bengal) to draft this tax law.

- 2004- The Fiscal Responsibility and Budget Management Committee came into action and proposed to implement this tax system.

- 2010- The first discussion paper on GST was released.

- 2014- The 122nd Constitution Amendment Bill introduced Goods and Services Tax to the Lok Sabha after a failure in 2011.

- 2015- Lok Sabha approved the bill.

- 2016- Rajya Sabha approved the bill. The Goods and Services Tax Council came into existence.

- 2017- On 1st July, the bill came into action officially.

Which of the following Indirect taxes was not absorbed by GST ?

Types of GST

Central Goods and Service Tax (CGST): It is the tax collected by the Central Government on an intra-state sale (e.g., a transaction happening within Karnataka)

State Goods and Service Tax (SGST): It is the tax collected by the state government on an intra-state sale (e.g., a transaction happening within Karnataka)

Integrated Goods and Service Tax (IGST): It is a tax collected by the Central Government for an inter-state sale (e.g., Karnataka to Maharashtra)

Output Tax and Input Tax in GST:

GST Output: Once a business is registered under GST, it must charge GST on all supplies at the prevailing rate. This GST i.e. charged and collected is known as output tax.

GST Input: The GST that is paid on business purchases and expenses (including import of goods) is known as input tax. If business satisfies the conditions for claiming input tax, it can claim the input tax on business purchases and expenses.

This input tax credit mechanism ensures that only the value added is taxed at each stage of a supply chain.

Charge of GST

GST is applicable based on taxable event i.e. Supply and is payable based on the Time of Supply.

Definitions:

Goods and Services:

“Goods’’ means every kind of movable property other than money and securities but includes actionable claims, growing crops, grass and things attached to or forming part of the land which are agreed to be severed before supply or under a contract of supply.

The above is summarized as under:

Goods include:

- Every kind of movable property

- Actionable claims (Lottery, betting and gambling)

- Growing crops, grass and things attached to or forming part of the land which are agreed to be severed before supply or under a contract of supply.

Goods does not include:

- Money and

- Securities

“Services” means anything other than goods, money and securities but includes activities relating to the use of money or its conversion by cash or by any other mode, from one form, currency or denomination, to another form, currency or denomination for which a separate consideration is charged.

Exclusion from GST (Non Taxable Supply):

- Alcohol for human consumption

- Petroleum and petroleum products (To be included from a date to be recommended by the GST Council)

- Electricity (Taxes on the consumption or sale of electricity)

- Real Estate (Sale/purchase of immovable property)

Classification of goods and services (HSN & SAC)

Every good or service are classified using a numbering system to identify and tax them correctly. For goods, HSN is used and for the services, SAC is used. Let us understand them:

a. Harmonized System of Nomenclature (HSN):

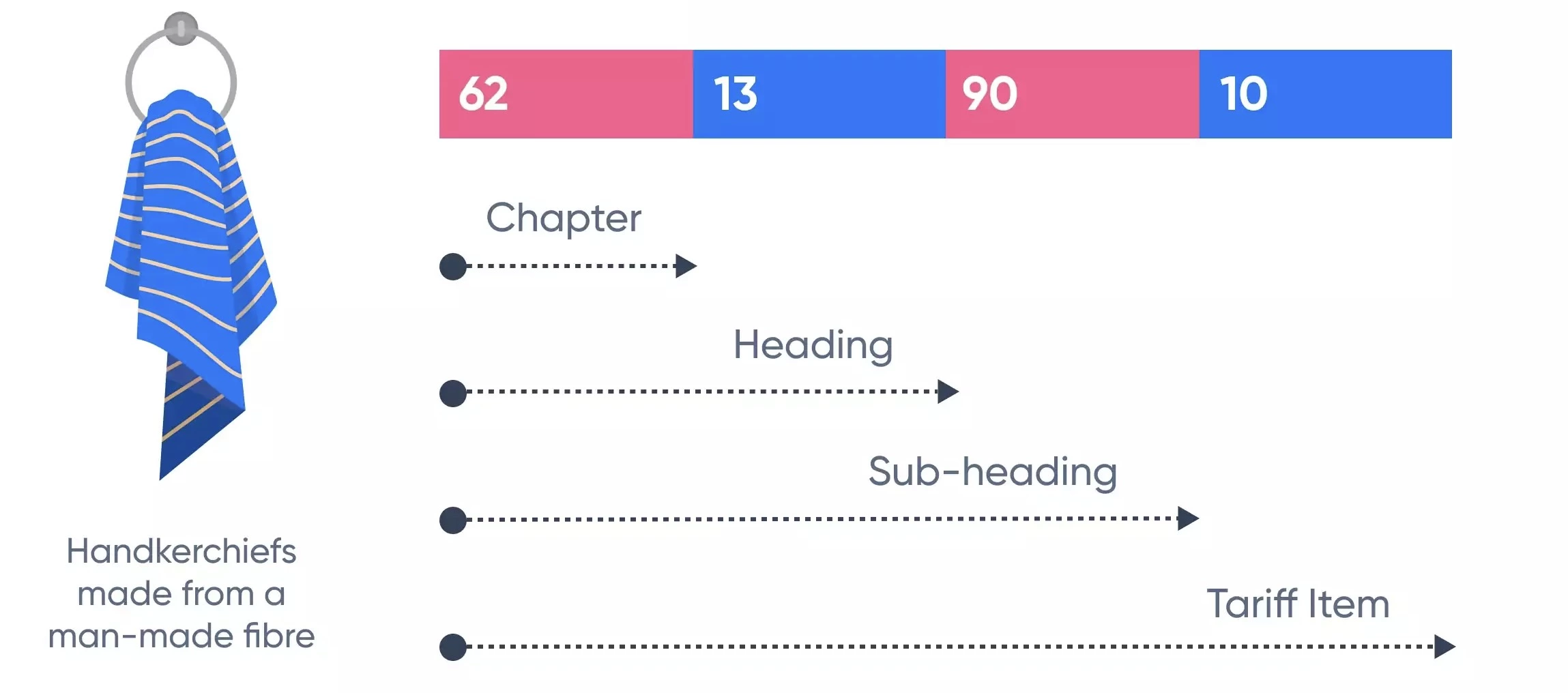

HSN code stands for “Harmonized System of Nomenclature”. This system has been introduced for the systematic classification of goods all over the world. HSN code is a 6 to 8-digit uniform code that classifies 5000+ products and is accepted worldwide. It was developed by the World Customs Organization (WCO) and it came into effect from 1988.

For example: The HSN for Handkerchiefs made of Textile matters is 62139010.

b. Services Accounting Code (SAC):

For example: Legal documentation and certification services concerning patents, copyrights and other intellectual property rights: 998213

- The first two digits are same for all services i.e. 99

- The next two digits (82) represent the major nature of service, in this case, legal services

- The last two digits (13) represent detailed nature of service, i.e., legal documentation for patents etc.