US CMA

The Certified Management Accountant (CMA) designation is a globally recognized certification that demonstrates expertise in financial management and strategic decision-making. Offered by the Institute of Management Accountants (IMA), the CMA credential is designed for professionals seeking to advance their careers in management accounting and finance.

View DemoCourse Syllabus

Part 1

| Part | Description | Weightage |

|---|---|---|

| A | External Financial Reporting Decisions | 15% |

| B | Planning, Budgeting, and Forecasting | 20% |

| C | Performance Management | 20% |

| D | Cost Management | 15% |

| E | Internal Controls | 15% |

| F | Technology and Analytics | 15% |

Part 2

| Part | Description | Weightage |

|---|---|---|

| A | Financial Statement Analysis | 20% |

| B | Corporate Finance | 20% |

| C | Decision Analysis | 25% |

| D | Risk Management | 10% |

| E | Investment Decisions | 10% |

| F | Professional Ethics | 15% |

Get access to this course in Lab &Lab+. Compare

Lab

10% Off

₹64000

₹57600

Lab+

10% Off

₹80000

₹72000

This course includes:

Modules

4

Chapters

6

MicroVideos

36

Case Studies

16

Assessments

91

Recordings

10+

Languages

15

Sessions conducted by

Akshay Chopda

CMA | M.Com, NET | Director @ Fincurious

A professional with experience in accounting, audit, taxation, and finance, with a focus on adaptability, quick learning, and continuous skill development to align with industry requirements.

Benefits of this course:

Global Recognition

The CMA is respected in over 150 countries with over 100,000 certifications earned globally.

Career Advancement

A CMA certification helps accounting and finance professionals rise higher inside companies and organizations.

Earn More

CMAs earn significantly higher annual compensation on average compared to non-CMAs.

Your Path to a Career in Finance

Register with the IMA

Take the first step by signing up with the Institute of Management Accountants.

Start Studying with FinCurious

Begin your journey with comprehensive study material and expert guidance.

Take up Part 1/2 Exam

Put your knowledge to the test and clear your exams.

Study for the Next Part

Continue with your preparation for the remaining part of the exam.

Take up Part 1/2 Exam

Complete your certification by clearing the second part.

Set on Path for a Career in Finance

Achieve your dreams and embark on a successful career in finance.

CMA vs CPA vs CA vs ACCA

Why is CMA preferred?

| Feature | CMA (US) | CPA (US) | CA (India) | ACCA |

|---|---|---|---|---|

| Full Name | Certified Management Accountant | Certified Public Accountant | Chartered Accountant | Association of Chartered Certified Accountants |

| Primary Focus | management accounting and strategy | Public accounting and auditing | Comprehensive accounting, auditing, taxation | global accounting standards and practices |

| Number of Exams | 2 parts | 4 parts | 20 papers | 13 papers |

| Course Duration | Approximately 1 year | Approximately 1 year | 4.5 years | 3 years |

| Work Experience Requirement | 2 years | 2 years | 3 years practical training | 3 years Practical Experience Requirement (PER) |

| Exam Frequency | Offered 3 times a year | Quarterly | Semi-annual | Quarterly |

| Eligibility Criteria | Bachelor's degree and membership in IMA; must pass both exam parts | Bachelor's degree and specific coursework in accounting | Appearing after Higher Secondary with minimum marks in relevant subjects | Master's in India |

| Accounting Standards Used | US GAAP | US GAAP | Ind-AS | IFRS |

| Geographical Recognition | Primarily USA | Primarily USA | Primarily India | Global |

| Average Salary Range (Entry-Level) | $60,000 - $80,000 | $55,000 - $70,000 | INR 2 LPA to INR 16 LPA | $50,000 - $70,000 |

How you'll learn!

Practically learn in our Lab! Get the best practical experienece in all topics with Case Studies, Gamification, Simulation etc. in your language!

Recommended Courses for you!

More Features in Lab!

Interactive UI

You will not just learn the subject material, you will Experience it! You will be asked to complete small tasks and answer a few questions which helps you in remembering the topic for a longer time.

Learn in 15+ Languages with AI

Not able to understand technical words? Translate it to the language of your choice and learn easily! 15 Languages are currently supported, and we are adding more soon...

Earn FinC Coins!

Every time you Input the correct answer, or achieve something in the given time, you will be awarded with Coins! Use these to get discounts on future courses and get discounts!

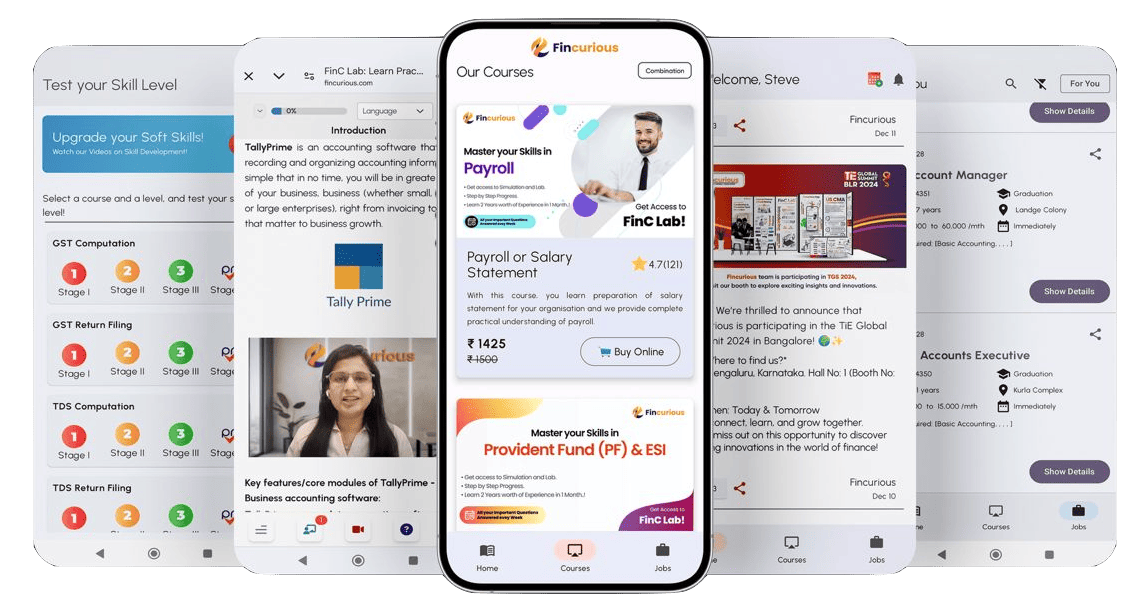

Download our App

Download our Android app and get access to the same study materials on the go! Also get notifications about when the class is starting or when your access is about to expire.

Full Access to all Features

Zero Ads, as it should be!

Important Notifications Only!

Access Everything

from Everywhere!

Have More Questions?

Submit your details. Our Team will get back to you shortly.